In modern finance, cryptocurrency has been the undeniable disruptor, reshaping traditional notions of currency and transactions. But what’s even more fascinating is its ripple effect beyond the financial realm, particularly in real estate.

Picture this: for ages, buying or selling property meant navigating a labyrinth of paperwork and face-to-face negotiations. It was like a scene from an old movie, right?

Enter blockchain, the game-changer. Just as it revolutionized how we think about money, it’s doing the same for real estate. Now, instead of dusty file cabinets and endless forms, we have smart contracts and tokenization. It’s like real estate meets the digital age. With blockchain, property transactions become as smooth as trading cryptocurrencies. No more waiting for signatures or dealing with middlemen. It’s all about transparency, security, and accessibility.

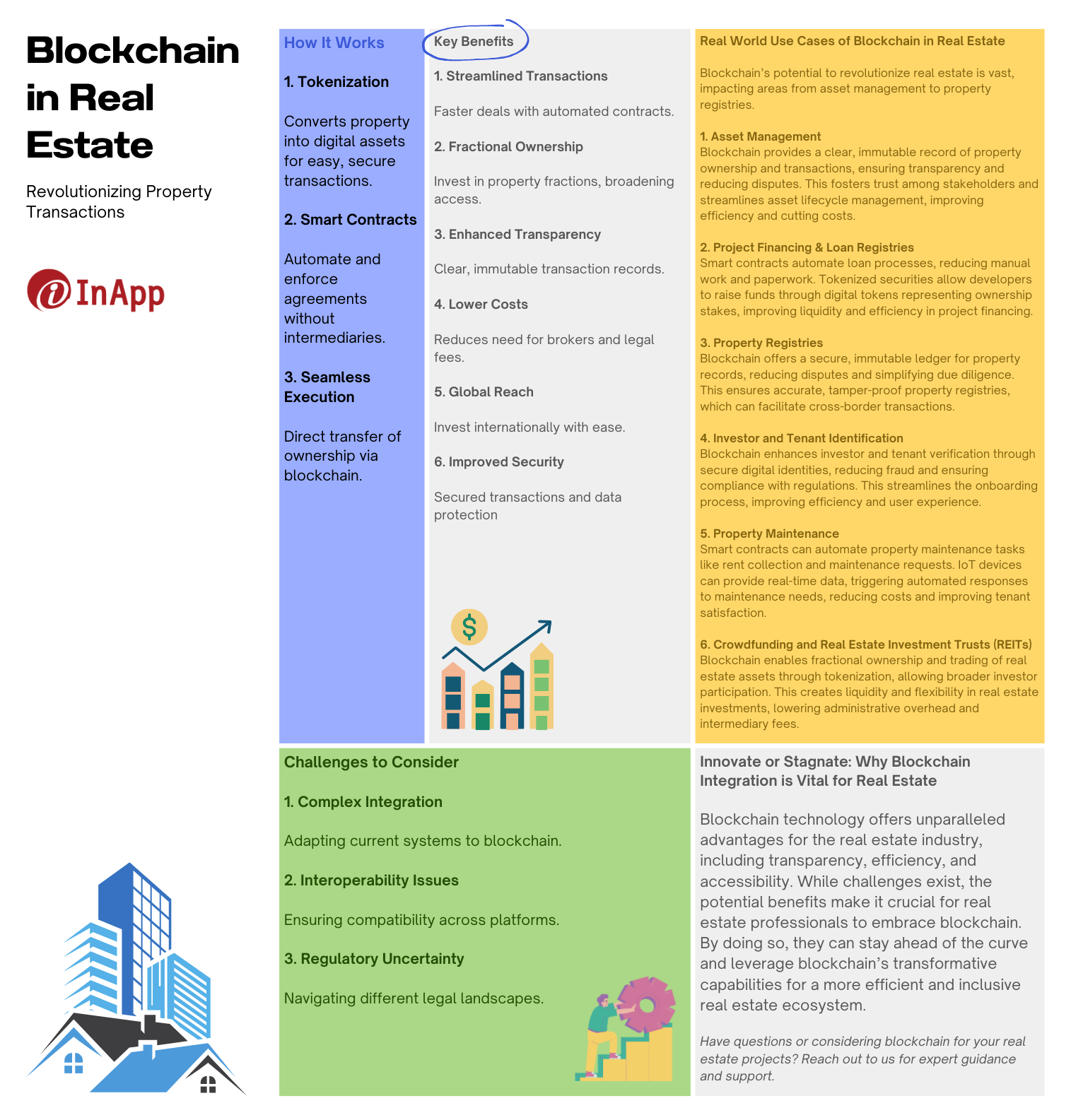

How Does Blockchain Work in Real Estate?

Alright, so picture blockchain as this super-smart digital ledger. It’s like a giant book where every transaction is recorded in a way that’s tamper-proof and transparent. Now, let’s bring real estate into the mix. Traditionally, buying or selling property involved heaps of paperwork and a whole lot of back-and-forth. But with blockchain, things get way smoother.

Here’s how it works –

Step 1: Tokenization

Firstly, the property undergoes tokenization, converting it into digital assets akin to digital currency. This process facilitates its representation on the blockchain network.

Step 2: Smart Contracts

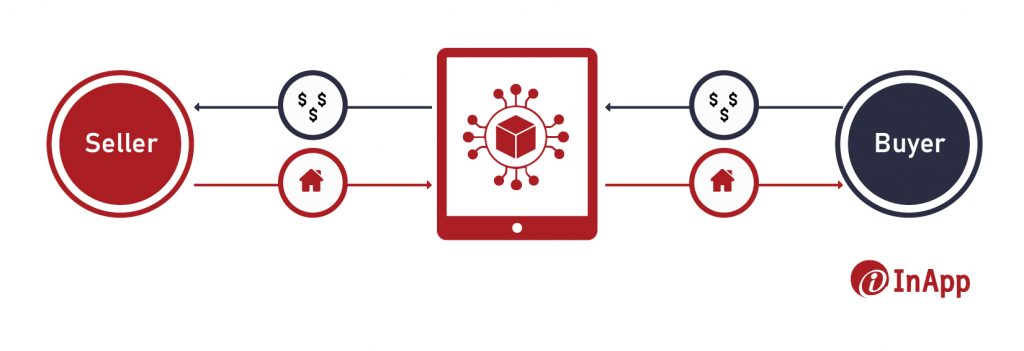

Next, smart contracts come into play. These are digital agreements programmed to execute automatically when predetermined conditions are met. In real estate transactions, smart contracts ensure the seamless transfer of ownership and assets without the need for intermediaries.

Step 3: Execution

When a buyer wishes to acquire the property, the smart contract is triggered. It verifies the terms of the agreement and executes the transaction, transferring ownership from the seller to the buyer automatically.

Blockchain’s decentralized nature eliminates the need for intermediaries like real estate agents. Transactions occur directly between the involved parties, streamlining the process and reducing associated costs. Every transaction is securely recorded on the blockchain, ensuring transparency and reducing the risk of fraud or tampering.

How Has Blockchain Revolutionised the Real Estate Industry?

Remember those days when buying or selling property felt like navigating a maze? Well, blockchain stepped in and changed the whole scenario. Now, the traditional real estate scene is getting a makeover, and it’s all about transparency and security.

In this blog section, we’re diving into six ways the real estate industry is riding the blockchain wave, making transactions smoother, safer, and way cooler.

1. Streamlined Transactions

Gone are the days of endless paperwork and convoluted processes. With blockchain, real estate transactions are streamlined to a whole new level. Smart contracts, the digital agreements coded into the blockchain, automate the execution of transactions once predefined conditions are met. This means that buyers and sellers can skip the lengthy negotiation processes and cumbersome paperwork, allowing for swift and seamless property transfers.

2. Fractional Ownership

Blockchain has democratized real estate investment by enabling fractional ownership. Through tokenization, properties can be divided into smaller, tradable units, allowing investors to purchase fractions of high-value assets. This opens up real estate investment opportunities to a wider pool of individuals who may not have had access to such investments previously. Fractional ownership also reduces the barriers to entry for aspiring real estate investors, making the market more inclusive and dynamic.

3. Enhanced Transparency

Transparency is a cornerstone of blockchain technology. Every transaction recorded on the blockchain is immutable and transparent, creating an auditable trail of ownership and transaction history. This transparency instills trust in the real estate market, as buyers can verify the authenticity of property records without relying on intermediaries. Additionally, blockchain’s decentralized nature reduces the risk of fraudulent activities, as the ledger is maintained by a network of nodes rather than a single centralized authority.

4. Reduced Costs and Intermediaries

By eliminating intermediaries such as brokers, lawyers, and escrow agents, blockchain significantly reduces transaction costs in real estate. Smart contracts automate many of the tasks traditionally performed by intermediaries, saving both time and money for all parties involved. Additionally, the decentralized nature of blockchain removes the need for costly third-party verification processes, further bringing down transaction costs. This cost reduction makes real estate investment more accessible to individuals democratizing access to the market.

5. Global Accessibility

Blockchain technology transcends geographical boundaries, enabling real estate transactions to occur seamlessly across borders. Through tokenization, investors can diversify their portfolios by investing in properties located in different countries without the logistical challenges typically associated with cross-border transactions. This global accessibility opens up new avenues for real estate investment and fosters international collaboration in the real estate market.

6. Improved Security

Security is paramount in real estate transactions, where large sums of money are exchanged and sensitive information is shared. Blockchain’s cryptographic algorithms ensure that data stored on the ledger is tamper-proof and secure from unauthorized access. Additionally, smart contracts execute transactions automatically based on predefined conditions, reducing the risk of human error and fraud. This heightened security not only protects the interests of buyers and sellers but also enhances the overall integrity of the real estate market.

Real World Use Cases – How Can Blockchain Be Used in Real Estate?

Blockchain technology has the potential to revolutionize the real estate industry across various aspects, from asset management to property registries and beyond. Here are some use cases on how blockchain can be utilized in real estate.

- Asset Management

Blockchain technology aids asset management in real estate by providing a clear and immutable ledger. Each transaction, from property tokenization to transfers of ownership, is securely documented and accessible to all involved parties.

Real-time tracking of asset ownership, transactions, and changes ensures transparency throughout the asset lifecycle management. This transparency fosters trust among stakeholders, reduces disputes, and facilitates efficient decision-making processes. Additionally, by eliminating the need for intermediaries, blockchain enhances operational efficiency and reduces administrative costs in asset management.

- Project Financing & Loan Registries

Blockchain technology can streamline project financing and loan registries in the real estate sector. Smart contracts can automate the entire loan process, from origination to repayment, reducing the need for manual intervention and paperwork. Through tokenized securities, developers can raise funds for real estate projects by issuing digital tokens representing ownership stakes in the project. These tokens can be traded on blockchain-based platforms, providing liquidity to investors and fostering a more efficient capital market for real estate development.

- Property Registries

Unlike traditional property registries that are often fragmented and prone to errors and fraud, Blockchain offers a secure and immutable ledger for recording property ownership and transaction history. Each property can be assigned a unique digital identity on the blockchain, which contains information such as ownership records, liens, encumbrances, and historical transactions.

This transparent and tamper-proof registry reduces disputes, simplifies due diligence, and enhances trust in real estate transactions. Moreover, blockchain-based property registries can facilitate cross-border transactions by providing a standardized platform for verifying property ownership rights.

- Investor and Tenant Identification

Blockchain technology can improve the identification and verification of investors and tenants in the real estate industry. Digital identities stored on the blockchain can provide a secure and tamper-proof method of verifying the identity of individuals and entities involved in real estate transactions.

This reduces the risk of fraud and enhances compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. Moreover, blockchain-based identity solutions can streamline the onboarding process for investors and tenants, reducing administrative burdens and improving the overall user experience.

- Property Maintenance

Smart contracts can revolutionize property maintenance by automating tasks such as rent collection, maintenance requests, and lease renewals. Through IoT devices and sensors installed in properties, real-time data on property conditions can be recorded on the blockchain. Smart contracts can then trigger maintenance requests or rent payments automatically based on predefined conditions. This improves efficiency, reduces costs, and enhances the tenant experience by ensuring timely maintenance and payments.

- Crowdfunding and Real Estate Investment Trusts (REITs)

Blockchain technology enables crowdfunding platforms and Real Estate Investment Trusts (REITs) to offer fractional ownership of real estate assets to a wider pool of investors. Through tokenization, investors can purchase digital tokens representing ownership stakes in real estate properties. These tokens can be traded on blockchain-based platforms, providing liquidity and flexibility to investors. Crowdfunding platforms and REITs can leverage blockchain to streamline the issuance, trading, and settlement of digital securities, reducing administrative overheads and intermediaries’ fees.

Blockchain technology holds immense promise for transforming the real estate industry across various aspects, from asset management to property registries and beyond. By leveraging blockchain’s decentralized and transparent ledger, real estate stakeholders can streamline operations, reduce costs, enhance security, and unlock new opportunities for investment and innovation.

As blockchain continues to evolve and mature, its adoption in the real estate industry is poised to accelerate, paving the way for a more efficient, transparent, and inclusive real estate ecosystem.

Navigating the Challenges – Implementing Blockchain in Real Estate

Implementing blockchain in real estate comes with its own set of challenges, despite its potential benefits. One major hurdle is the complexity of existing real estate processes and regulations, which may not easily integrate with blockchain technology. Additionally, transitioning from traditional systems to blockchain-based solutions requires significant investment in infrastructure, training, and education.

Moreover, interoperability and standardization pose challenges in the adoption of blockchain across different real estate platforms and jurisdictions. Different blockchain protocols and platforms may not be compatible with each other, leading to fragmentation and inefficiencies in the real estate market. Standardization efforts are needed to develop common protocols and standards for data exchange and smart contracts in real estate transactions.

Another challenge is the scalability of blockchain networks. As real estate transactions involve large volumes of data and require high throughput, existing blockchain networks may struggle to handle the scale and complexity of real estate transactions.

While blockchain offers immutable and transparent records, ensuring the security and privacy of sensitive real estate data is paramount. Blockchain-based identity solutions and encryption techniques can help protect sensitive information, but robust security measures are needed to prevent unauthorized access and data breaches.

Moreover, regulatory uncertainty and legal challenges may hinder the adoption of blockchain in real estate. Different jurisdictions have varying regulations governing real estate transactions, and blockchain-based solutions may need to comply with existing legal frameworks. Clear guidelines and regulatory frameworks are needed to ensure the legality and enforceability of blockchain-based real estate transactions.

Innovate or Stagnate – Why Blockchain Integration is Vital for the Real Estate Industry?

In conclusion, blockchain technology has ushered in a new era for the real estate industry, offering unparalleled advantages such as transparency, efficiency, and accessibility. Despite facing challenges in implementation, the importance of integrating blockchain into real estate processes cannot be overstated.

Embracing blockchain is not just about staying ahead of the curve; it’s about embracing innovation that has the potential to revolutionize the industry. As we navigate the challenges together, real estate professionals must recognize the immense value that blockchain brings and seize the opportunities it presents. Have questions or considering implementing blockchain in your real estate projects? Reach out to us for expert guidance and support.