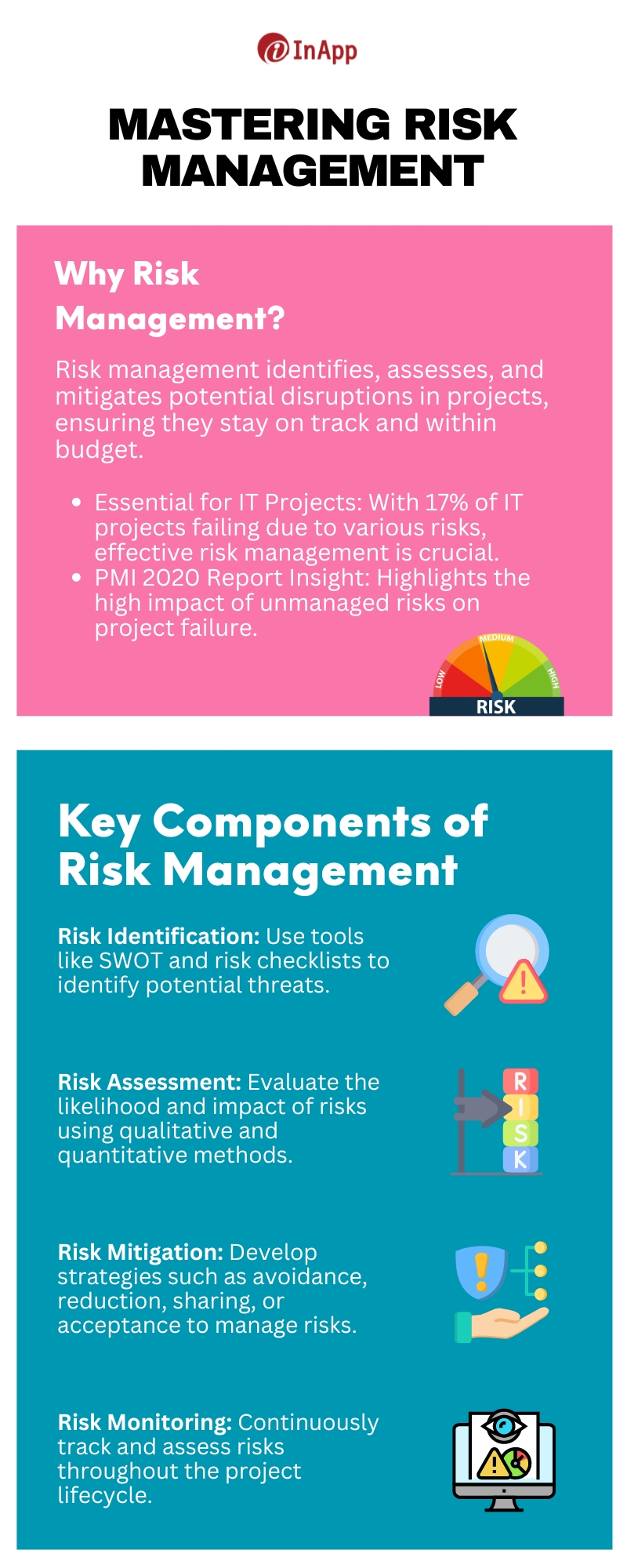

Risk management is a critical component for the success of any project or organization. No project is risk-proof, and this holds especially true for IT projects. From clients frequently changing their requirements to overshooting budgets and deadlines, various risks can jeopardize the success of IT initiatives.

According to the 2020 PMI report, “17% of IT projects fail due to numerous risks.”

This guide aims to equip you with the knowledge and tools necessary to implement effective risk management practices. We will cover the fundamentals of risk management, its significance in the IT project sector, and practical strategies for identifying, assessing, and mitigating risks.

What is Risk Management and Why is it Important?

Risk management is the process of identifying, assessing, and mitigating potential risks that could negatively impact a project or organization. It involves systematically analyzing uncertainties to minimize their effects on achieving goals.

The importance of risk management lies in its ability to safeguard projects and operations from unexpected issues. By proactively addressing risks, organizations can avoid or reduce potential losses, ensure timely project delivery, and stay within budget. Effective risk management also enhances decision-making, promotes a culture of preparedness, and boosts stakeholder confidence.

What Are The Key Components of Risk Management?

Risk management comprises several essential components that ensure projects and organizations can navigate uncertainties effectively. Here’s a detailed look at each key component:

1. Risk Identification

Risk identification involves systematically identifying potential risks that could impact project objectives. This process requires a comprehensive analysis of internal and external factors, past experiences, stakeholder inputs, and industry trends. Various techniques such as brainstorming sessions, SWOT analysis (Strengths, Weaknesses, Opportunities, Threats), and risk checklists are employed to identify risks. The goal is to create a comprehensive list of potential threats and opportunities that could affect project success.

2. Risk Assessment

Once risks are identified, the next step is risk assessment. This involves evaluating the likelihood of each risk occurring and the potential impact it could have on the project. Risks are typically assessed based on their severity, probability of occurrence, and detectability.

Qualitative methods assign subjective ratings (low, medium, high) to risks based on expert judgment, while quantitative methods use data and statistical analysis to quantify risks numerically. The assessment phase helps prioritize risks, focusing resources on addressing those with the highest potential impact.

3. Risk Mitigation

Risk mitigation involves developing strategies to reduce the likelihood or impact of identified risks. This proactive approach aims to either eliminate the risk entirely or minimize its effects.

Some proven risk mitigation strategies are:

- Risk avoidance – Changing project scope to avoid the risk

- Risk reduction – implementing controls to lower risk probability or impact

- Risk sharing – Transferring risk to a third party, like insurance

- Risk acceptance – Accepting the risk with contingency plans in place

Effective mitigation strategies are tailored to each specific risk and aligned with project goals and constraints.

4. Risk Monitoring

Risk monitoring is an ongoing process throughout the project lifecycle. It involves tracking identified risks, assessing their status, and evaluating the effectiveness of mitigation strategies. Regular monitoring ensures that new risks are identified promptly and that existing risks are managed effectively as project conditions evolve. Communication and reporting play a crucial role in risk monitoring, keeping stakeholders informed of risk status, and any necessary adjustments to mitigation plans.

By integrating these key components into a cohesive risk management framework, organizations can proactively address uncertainties, enhance decision-making, and increase the likelihood of project success.

Check out the podcast by Suni Stanes, (Senior Manager, Software Quality Assurance) for deeper insights into risk management strategies.

Understanding The Different Types of Risks

Understanding the different types of risks is crucial for effective risk management in any project or organization. Here, we explore five key categories of risks:

1. Project Risks

Project risks are specific to the activities and objectives of a project. These risks can arise from factors such as inadequate planning, resource constraints, technical challenges, and scope changes. For example, delays in deliverables, budget overruns, or technology failures are common project risks that can impact timelines and outcomes. Effective project risk management involves identifying potential threats early, assessing their likelihood and impact, and implementing strategies to mitigate them throughout the project lifecycle.

2. Organizational Risks

Organizational risks encompass threats that affect the overall functioning and performance of an organization. These risks can stem from internal factors such as poor governance, leadership changes, operational inefficiencies, or financial instability. External factors like regulatory changes, economic downturns, or shifts in market conditions can also pose organizational risks.

Managing organizational risks requires a holistic approach that involves aligning strategic objectives with risk tolerance, establishing clear policies and procedures, and fostering a culture of risk awareness and accountability across all levels of the organization.

3. External Risks

External risks originate from outside the organization and are often beyond its control. These risks can include geopolitical events, natural disasters, supplier disruptions, or changes in consumer behavior. For instance, supply chain interruptions due to geopolitical tensions or market volatility impacting customer demand are external risks that can impact business continuity. Mitigating external risks involves monitoring external environments, establishing contingency plans, diversifying suppliers, and maintaining strong relationships with stakeholders to adapt to changing circumstances swiftly.

4. Financial Risks

Financial risks pertain to potential losses or uncertainties related to financial management and investments. These risks can include market volatility, credit defaults, currency fluctuations, or liquidity issues. For example, fluctuating interest rates affecting borrowing costs or investment losses due to market downturns are financial risks that organizations must manage to maintain financial stability and profitability.

5. Compliance Risks

Compliance risks arise from non-adherence to laws, regulations, or industry standards applicable to the organization’s operations. Failure to comply with regulatory requirements can result in legal penalties, reputational damage, or operational disruptions. Examples include data privacy violations, regulatory fines, or breaches of industry codes of conduct.

Effective compliance risk management entails staying informed about regulatory developments, establishing robust compliance frameworks, conducting regular audits, and fostering a culture of compliance throughout the organization.

By implementing comprehensive risk management strategies tailored to each risk category, organizations can enhance resilience, optimize decision-making, and sustain long-term success in an increasingly complex and unpredictable business environment.

What Are The Benefits of Risk Management?

Risk management plays a pivotal role in enhancing project success and organizational resilience by proactively addressing potential threats. Here are the key benefits of implementing robust risk management practices:

1. Improved Project Planning and Scheduling

Effective risk management improves project planning and scheduling by identifying potential risks early in the project lifecycle. For example, imagine a software development project where the team identifies a risk of delays due to a third-party vendor not delivering components on time.

By recognizing this risk early, the project manager can explore alternative vendors or adjust the project timeline to mitigate potential delays. This proactive approach minimizes disruptions and ensures that deadlines are met consistently.

2. Cost Control and Financial Savings

Risk management contributes to cost control and financial savings by mitigating risks that could lead to budget overruns or unexpected expenses. Consider a construction project where the risk of fluctuating material costs is identified during the planning phase.

By incorporating a contingency budget for price increases and monitoring market trends, the project team can mitigate the financial impact of these risks. This proactive cost management approach ensures that the project remains within budgetary constraints and optimizes financial resources effectively.

3. Loss Minimization

One of the primary goals of risk management is to minimize potential losses associated with project failures or disruptions. Organizations can prevent or reduce the severity of negative outcomes by anticipating risks and implementing mitigation strategies.

For example, proactive risk management in IT projects can mitigate risks such as data breaches, system failures, or technology obsolescence, thereby minimizing downtime and potential revenue loss. By addressing risks systematically, organizations can protect their assets, reputation, and stakeholder interests.

4. Accurate Budget Estimations

Accurate budget estimations are crucial for project success, and risk management plays a key role in achieving this. By identifying potential risks that could impact project costs, such as inflation, regulatory changes, or unexpected resource requirements, organizations can incorporate contingencies into their budget estimates.

This ensures that financial plans are realistic and aligned with project objectives, reducing the likelihood of budget overruns. Moreover, accurate budget estimations foster transparency and accountability, enhancing trust and credibility with stakeholders.

5. Stakeholder Confidence

Effective risk management enhances stakeholder confidence by demonstrating proactive planning and preparedness. Stakeholders, including clients, investors, and project sponsors, are reassured knowing that potential risks have been identified and addressed. For instance, clear communication of risk management strategies and outcomes fosters transparency and builds trust with stakeholders, reinforcing their belief in the project’s success. Stakeholder confidence also facilitates smoother decision-making processes and encourages collaboration among project teams.

6. Better Resource Allocation

Risk management enables better resource allocation by prioritizing and optimizing resources based on identified risks and their potential impacts. By understanding resource dependencies and constraints, organizations can allocate resources more effectively to areas that are critical to mitigating risks.

For example, allocating additional resources to critical path activities or investing in technology upgrades to address security risks can enhance project outcomes and minimize resource wastage. This strategic approach to resource allocation improves efficiency, productivity, and overall project performance.

Effective risk management is essential for maximizing project success and organizational resilience. Embracing a systematic approach to risk management not only protects against potential threats but also positions organizations to capitalize on opportunities and maintain a competitive edge.

To Sum Up

Risk management in the software industry is not merely about avoiding negative outcomes; it’s about creating a proactive and resilient approach to project management. By systematically identifying, assessing, and mitigating risks, organizations can enhance their ability to deliver successful projects, improve operational efficiency, and maintain a competitive edge.

Implementing robust risk management practices ensures that software projects are better prepared to handle uncertainties, leading to more predictable and successful outcomes. Effective risk management is a vital practice that underpins the stability and growth of any organization.

Whether you’re looking to refine your current risk management strategy or starting from scratch, we’re here to help. Get in touch with us if you have any questions or need guidance on implementing effective risk management practices tailored to your software projects.